The project’s cost more than doubled to $4.2 billion from an estimated $2 billion because of factors including a rising labour costs and bad weather.

Once in production, the mine’s output has been consistently below expectations due to a series of technical problems in its ramp-up phase and market conditions, costing its Japan-based owners hefty impairment charges.

Mitsui Mining, which holds 25.87% stake in Caserones, will book a 20 billion yen ($193 million) loss from the operation in the current financial year while Mitsui, owner of a 22.63% stake in the mine, said it expected a 7 billion ($67 million) yen loss from the deal.

Ditching the loss-making copper mine is part of Mitsui’s reorganization and asset portfolio reconstructing, it said in a separate statement.

Mitsui gained access to Caserones in 2010 after buying a stake in Minera Lumina Copper Chile (MLCC), the mine operator. At the time, the mine had a planned annual capacity of 150,000 tonnes of copper concentrate and 30,000 tonnes of copper cathodes.

The operation’s expected annual production still falls short of that target, though it has recently stabilized at more than 100,000 tonnes.

On top of that, MLCC is facing fines of up to $54.8 million for infractions to provisions established in its mining permit.

Chile’s Superintendency of the Environment (SMA) had gone after Lumina before. In 2015, it order the company to pay $11.9 million for breaching environmental rules. At the time, it was the second-highest fine the SMA had imposed since it was created in 2012.

The largest penalty until then — $16 million — was issued in 2013 to Barrick Gold’s now shuttered Pascua Lama gold and silver mine.

Unwanted asset?

Market rumours last year suggested that JXTG Holdings Inc., JX Nippon Mining’s parent company, was mulling to sale its interest in Caserones in a deal that could fetch about $1 billion.

There was no sign of such plan in today’s release. While JX Nippon Mining didn’t disclose how much is paying for Mitsui’s stake, it did say the acquisition aimed to maintain and expand production volume at Caserones.

It also seeks to extend the mine’s life by investing in automation and other new technologies.

Completion of the deal is expected by the end of March 2021, the companies said.

The announcement comes amid strong copper prices, which almost hit a fresh two-and-half year high on Friday due to an ongoing row between Australia and China.

The three-month copper price on the London Metal Exchange was $6,968 per tonne on early Monday, up 31% from six months ago.

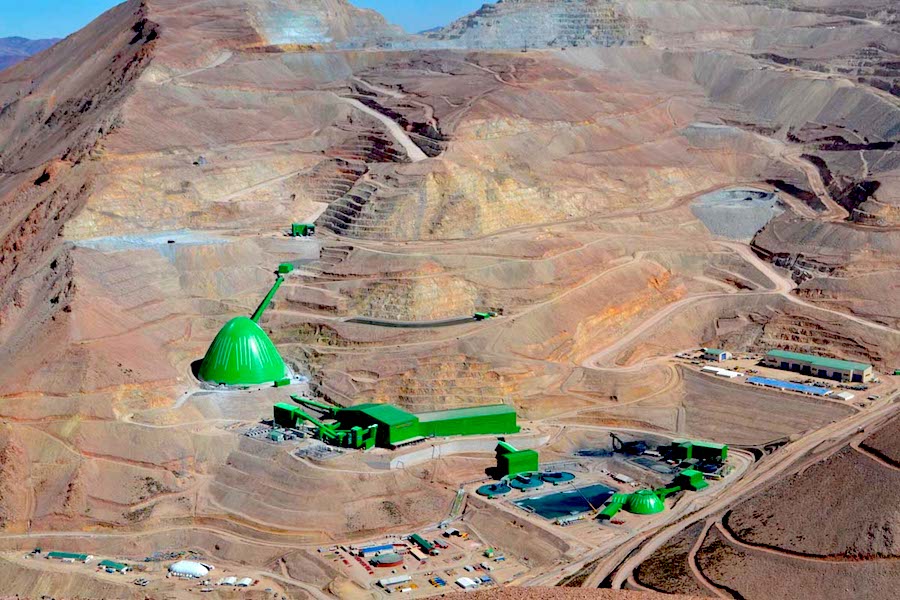

Caserones is located at an altitude of 4,200m to 4,600m above sea-level in Chile’s Atacama Desert, close to the border with Argentina.