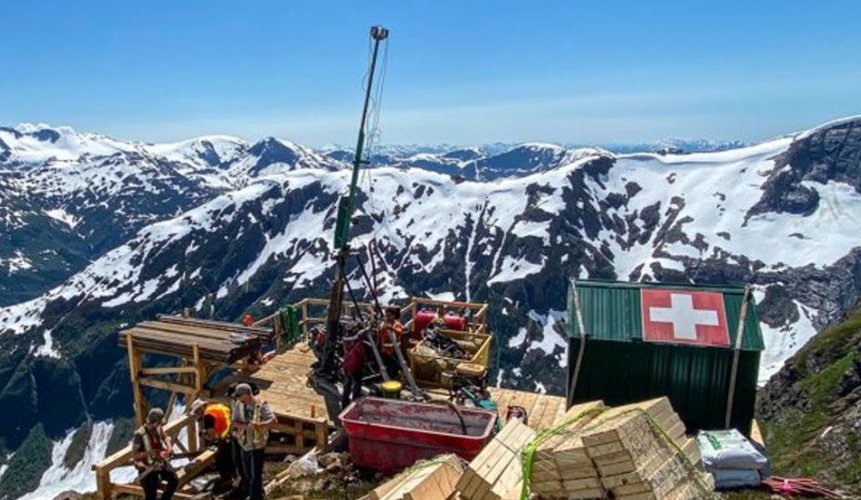

The funds will be directed to a significantly larger 2022 drill campaign, from a planned 18,000 metres to roughly 24,000 metres, at Goliath’s Golddigger property, specifically targeting the Surebet zone.

The drill campaign will include 85 holes from 24 pads to test the outer extremities of Surebet zone to determine the potential size of the system as well as the newly discovered adjacent Extension target to the southeast.

The Golddigger property covers nearly 24,000 hectares of area within the Golden Triangle region of British Columbia. Surebet is a high-grade polymetallic gold-silver shear zone that was subject of a 5,332-metre drill campaign last year, where all 24 holes of the program intercepted significant mineralization.

“This financing has put Goliath Resources in an excellent position to undertake an aggressive 2022 diamond drill program at Surebet,” Quinton Hennigh, geologic and technical director to Crescat Capital, commented. “This year’s program is designed to delineate a very large footprint, 1,0 million to 1.5 million square metres, of the moderately west-dipping Surebet zone with the aim of generating an initial resource.”

As shown in the 2021 drilling, true width of the Surebet mineralized zone averages around 6 metres, and the weighted average grade of drill intercepts is 6.3 g/t gold-equivalent.

“It is readily apparent this is a big prize and justifies a big drill program,” Hennigh added.

More information is available at www.goliathresourcesltd.com.