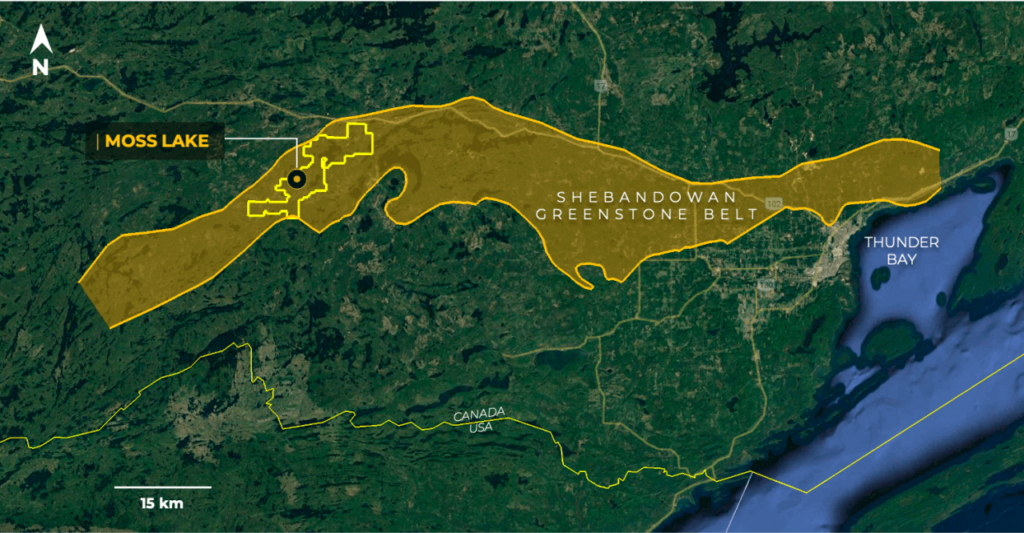

Goldshore closes $10M placement to fund Moss Lake exploration

Goldshore Resources (TSXV: GSHR; OTC: GSHRF) has closed its previously announced brokered private placement, which was led by Eventus Capital and Gravitas Securities as co-lead agents and joint bookrunners, on behalf of a syndicate including Laurentian Bank Securities.

The offering comprised the placement of 6.4 million common share units ($0.50 each), 9.6 million flow-through units ($0.60 each) and 1.4 million charity flow-through units ($0.71 each), for gross proceeds of $10 million. All of the units comprised one common share of Goldshore and one-half of a common share purchase warrant. Each whole warrant is exercisable at a price of $0.75 for a period of 24 months.