The offering is being led by Canaccord Genuity who is also acting as sole book-runner on behalf of a syndicate including National Bank Financial and Raymond James. Archer will pay a cash commission equal to 6% of the aggregate proceeds.

Each unit will consist of one common share of Archer and one common share purchase warrant. Each warrant will entitle the holder thereof to acquire one additional common share of Archer, at a price of $1.02 until two years after the closing date, which currently expected to be Nov. 18 of this year.

The company is expected to put the net proceeds from the offering toward exploration and development efforts of nickel assets and working capital. Proceeds from flow-through and charity flow-through units will be used for “Canadian exploration expenses” that qualify as flow-through critical mineral mining expenditures.

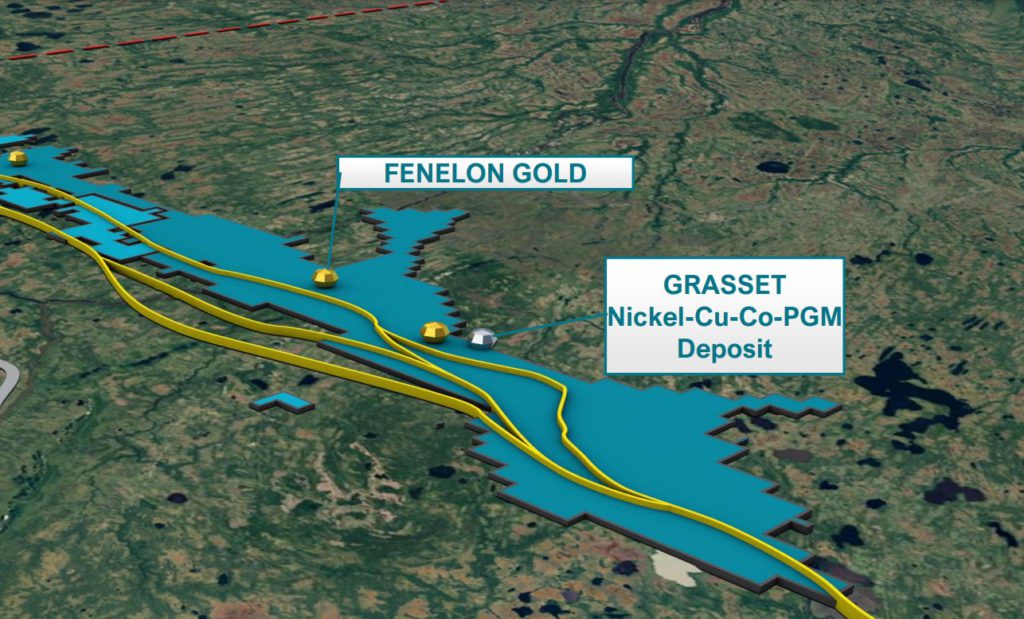

Archer is focused on building a portfolio of high-potential nickel sulphide projects. This summer in an all-share deal, the company agreed to purchase all the nickel assets belonging to Wallbridge Mining in Ontario and Quebec. Chief among these projects is Grasset, located about 55 km west-northwest of Matagami, Que. The arrangement resulted in Wallbridge becoming the 73% owner of Archer.

For more information visit www.ArcherExploration.com.