Rook is Canada’s largest development‑stage uranium project, focused on the Arrow deposit in the Athabasca Basin uranium hotspot, where NexGen holds 1,900 sq. kilometres. The project is within Treaty 8 land, the traditional territories of the Dene, Cree and Métis peoples.

Public licence hearings with the Canadian Nuclear Safety Commission were slated for Nov. 19 as press time approached and for Feb. 9 to 13, 2026, to determine whether Rook gets the green light. The commission approved the project’s environmental impact statement this past January.

NexGen has signed off-take agreements with undisclosed American utilities to provide 10 million lb. of uranium over about five years. Receiving approval for site development from the Saskatchewan Ministry of Environment in June, NexGen is advancing with planned gravel airstrip development and an expanded workers’ camp.

Rook I is expected to produce 27-29 million lb. of U3O8 annually over the first five years of its nearly 11-year life, according to a feasibility study released in August 2024. Last year, NexGen updated capital costs to $2.2 billion (US$1.58 billion) from $1.3 billion in 2021 due to inflation and improved engineering.

Using a long-term uranium price of US$95 per lb., Rook is expected to generate an average annual after-tax free cash flow of $1.93 billion in its first five years, according to the study. The project has an after-tax net present value of $6.3 billion at an 8% discount rate, and a payback period of about 12 months.

The Arrow deposit has a probable reserve of 4.6 million tonnes grading an average 2.4% uranium oxide (U3O8) for 240 million lb. U3O8, according to the feasibility study. Arrow hosts 3.8 million measured and indicated tonnes grading an average 3.1% U3O8 for 256.7 million lb. U3O8.

NexGen Energy has a market capitalization of C$7.43 billion.

Kabanga

Lifezone Metals (NYSE: LZM) has marked major milestones this year, releasing a feasibility study for its Tanzanian project Kabanga in July and consolidating ownership from former partner BHP (NYSE, LSE, ASX: BHP).

Located in northwest Tanzania between Rwanda and Burundi, Kabanga is one of the world’s largest nickel, copper and cobalt projects. It hosts proven and probable reserves of 52.2 million tonnes grading 1.98% nickel, 0.27% copper and 0.15% cobalt, according to a feasibility study released in July.

Lifezone agreed that month to pay BHP $83 million (C$117 million) for 17% of Kabanga, taking its ownership to 84% of the project, with the Tanzanian government holding the remainder.

In August, Lifezone secured a $60-million bridge loan from Taurus Mining to carry the company through to a final investment decision expected next year. Kabanga has attracted over $400 million in investment to date.

The company obtained a licence this year for its Kahama refinery. It allows for in-country production of battery materials using Lifezone’s patented Hydromet technology that could reduce the need for metallurgical smelting.

Over an 18-year mine life, the underground project could produce 902,000 tonnes of nickel, 134,000 tonnes of copper and 69,000 tonnes of cobalt in intermediate product, according to the July study.

Kabanga has a post-tax NPV (at an 8% discount rate) of $1.58 billion, an IRR of 23% and a payback period of 4.5 years, according to the study. Total life of mine capital spending would be $2.49 billion, including $942 million in pre-production plus contingency, capitalized operational expenditures, growth capital, sustaining and closure costs.

Life-of-mine revenue from sales would be $14.1 billion, net of realization costs, with after-tax free cash flow of $4.6 billion based on metal prices of $8.49 per lb. nickel, $4.30 per lb. copper, and $18.31 per lb. cobalt.

“We are well-positioned as we progress the project financing and commence early-stage development,” chief financial officer Ingo Hofmaier said in August. “We remain steadfast in our mission to drive long-term value creation.”

Lifezone Metals has a market capitalization of $286 million.

KSM

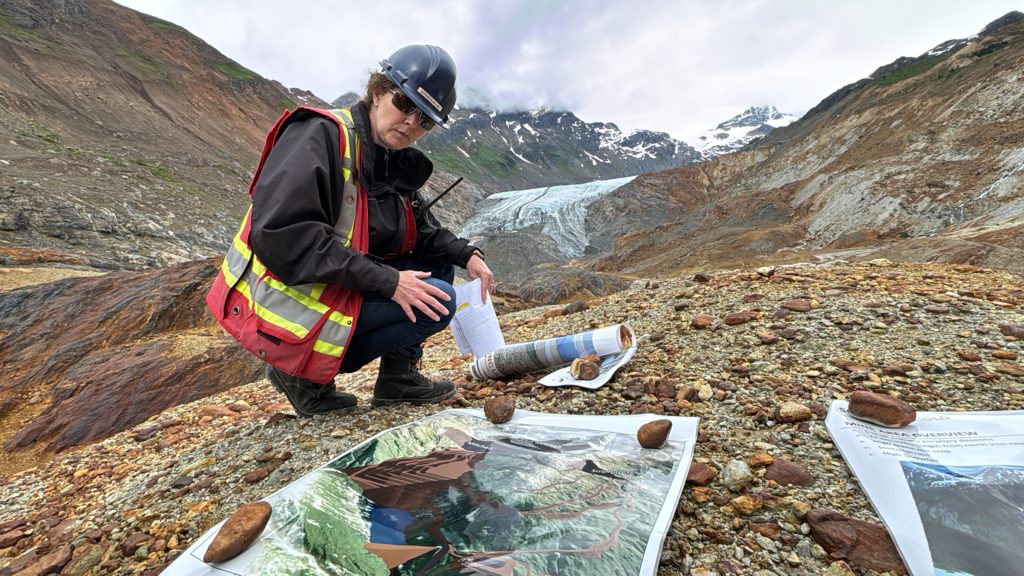

Seabridge Gold (TSX: SEA; NYSE: SA) is facing new roadblocks for its Kerr-Sulphurets-Mitchell (KSM) project, one of Canada’s largest gold-copper ventures, located near the Alaskan Panhandle in British Columbia.

In October, Seabridge was hit with its third legal challenge from Tudor Gold (CVE: TUD) which sued the B.C. government over permitting Seabridge to tunnel through its mineral resources. Seabridge has proposed two 23-km tunnels to connect either end of its KSM property, which Tudor claims would run through its own property.

This spring, B.C. ruled the project “substantially started” to remove any expiry from KSM’s Environmental Assessment Certificate, with court challenges heard in late September. No ruling had been made as press time neared.

The company aims to announce a joint-venture partner by year’s end and $20 million from an unnamed strategic investor. It’s funding geotechnical programs as the project advances towards a feasibility study.

Seabridge envisions a 33-year mine life for KSM with underground and open pit output that would cost $6.4 billion to build, according to a 2022 prefeasibility study.

With a pre-production period of four years, KSM may produce 1 million oz. of gold, 178 million lb. of copper, and 3 million oz. of silver annually.

The ore would be shipped to Pacific Rim smelters in Stewart, 65 km away. The town is 185 km by air north of Prince Rupert on the coast.

Across all zones, KSM’s reserves are 2.3 billion proven and probable tonnes grading 0.64 gram gold per tonne, 0.14% copper, 2.2 grams silver, and 76 parts per million molybdenum, according to the 2022 prefeasibility study. Contained metal is marked at 47.3 million oz. gold, 7.3 billion lb. copper, 160 million oz. silver and 385 million lb. molybdenum.

Seabridge’s 2022 preliminary economic assessment (PEA) focused on the opportunity to develop the copper-rich Kerr and Iron Cap deposits through block caving. Initial capital costs were pegged at US$14.3 billion, with additional sustaining capital and closure costs over the life of mine. The study also showed a post-tax NPV (at a 5% discount rate) of US$5.8 billion with an IRR of about 19%.

Seabridge Gold has a market capitalization of C$3.21 billion.