The find represents a much-needed morale boost for Mountain Province, the mine operator, in a dire year for an industry that was already depressed by the time covid-19 hit global markets.

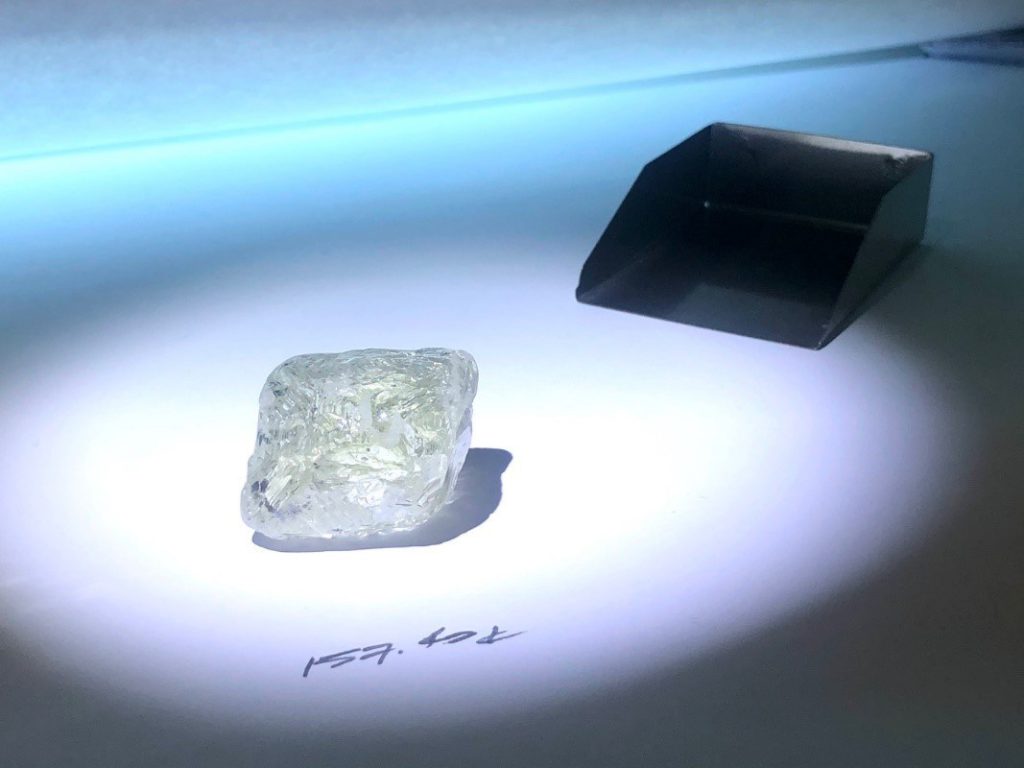

The discovery also shows that Gahcho Kué, a high-volume producer of mostly smaller diamonds, does have the ability to produce gems of exceptional size and quality, Mountain Province’s chief executive, Stuart Brown, said in the statement.

The diamond junior said it was beginning to see signs of recovery in the industry.

“Rough diamond prices, in the larger and better-qualities have been exceptional and pleasingly we saw further improvement in the smaller and lower quality diamonds which we believe will continue to strengthen in 2021,” Brown noted.

Sales up

The Toronto-based diamond miner also reported a strong fourth-quarter sales performance with 956,348 carats sold for C$80.2-million ($63m), resulting in an average value of C$83.82 ($66) per carat.

“The diamond industry has faced immense challenges during 2020 so to end the year with such a strong sales performance is very encouraging,” Brown said.

Mountain Province’s revenue for the fourth quarter of the year surpassed analysts’ expectations.

“[It] beat our estimates by 12% on higher volumes and slightly better prices,” BMO’s Edward Sterck said on Thursday. “It suggests that demand for Gahcho Kué goods was strong ahead of the all-important holiday season in the diamonds calendar, possibly helped by the closure of Rio Tinto’s Argyle mine, which was a major supplier of diamonds that overlapped with Gaucho Kué’s in terms of quality and market position.”

De Beers, the world’s largest diamond producer by value and the holder of a 51% stake in Gahcho Kué, was one of the first players to notice green shoots in the market.

The Anglo American unit, which sells diamonds to a handpicked group of about 80 buyers 10 times a year at events called sights, made about three times as much in sales of roughs in September as it did in the previous event.

De Beers saw sales rise further in the latest sale of the year, held in November.

Earlier this week, the diamond major increased diamond prices for the first time since the outbreak of the global pandemic, signalling growing confidence in a rebound for the struggling industry.