The initial capital requirement is US$341 million for a large-scales underground mine. Annual silver-equivalent production will average 14.2 million oz. (5.8 million oz. silver yearly) at an all-in sustaining cost of US$13.27/oz. silver-equivalent sold. Silver will represent 42% of revenues, and zinc will represent 39% of revenues. An additional US$168 million is anticipated for sustaining capital.

The Cero Las Minitas project has an indicated reserve of 12.3 million tonnes averaging 106 g/t silver, 0.16% copper, 1.3% lead, and 3.3% zinc, containing 42.1 million oz. silver, 44 million lb copper, 358 million lb. lead, and 895 million lb. zinc. The inferred resource is 29.6 million tonnes averaging 117 g/t silver, 0.23% copper, 1.2% lead, and 2.3% zinc, containing 73.6 million oz. silver, 98 million lb. copper, 500 million lb. lead, and 1.01 billion lb. zinc. Only sulphide mineralization was included in the study.

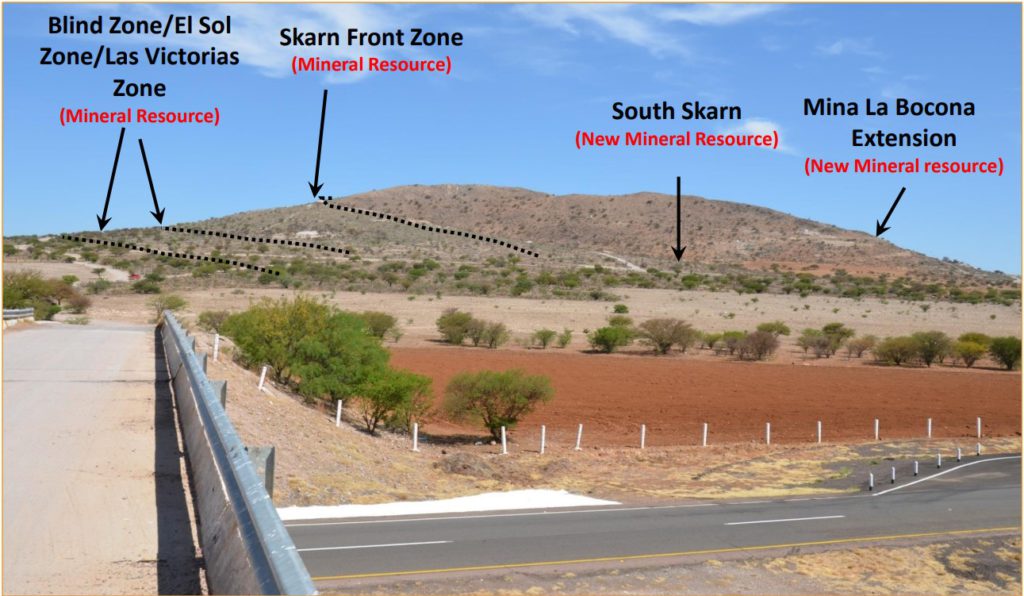

Southern Silver anticipates there is further exploration upside at the project. Current drilling and confirmed extensions to the Mina La Bocona and Skarn Front deposits, neither of which is included in the resources.

The mining plan foresees the use of longitudinal and transverse long hole stoping methods. Two separate portals are proposed, one to access the Blind-El Sol and Skarn Front deposits, and the second to access the La Bocona and South Skarn deposits.

The mineral processing plant will have a 4,500 t/d nominal capacity. The process consists of primary crushing, a 15,000-tonne run-of-mine stockpile, reclaim and secondary crushing, closed circuit ball milling, and sequential copper-lead-zinc flotation circuit producing three filtered concentrates for sale.

A portion of the tailings will be returned to the mine as cemented paste fill, and the remainder will be dry stacked on the surface.

Visit www.SouthernSilverExploration.com for additional information.