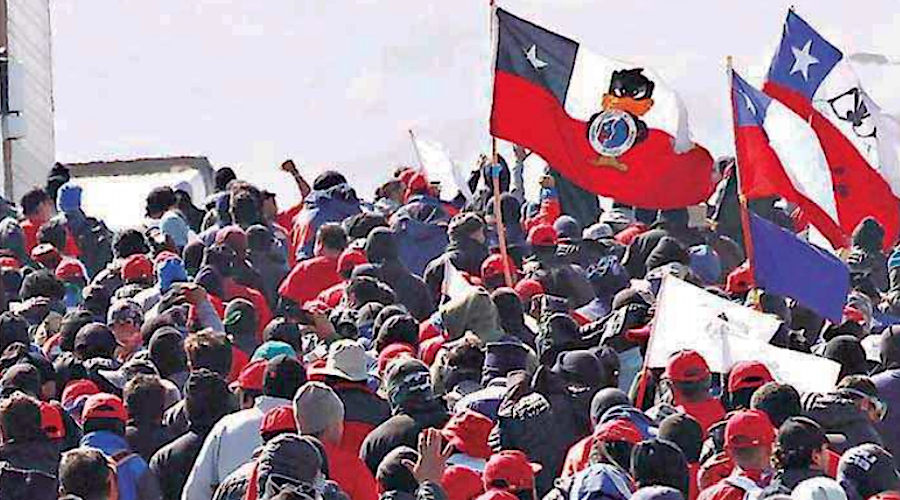

The deal, which was subject to vote, came after days of negotiations with union representatives, who had called for a strike on Nov. 21 and Nov. 23 due to multiple “non-compliances, infractions and violations” allegedly committed by BHP.

“This proposal contains a series of concrete and verifiable measures to improve the hygiene and safety of workers,” the union said in a statement. “Especially an intense joint inspection program between the union and the company of all work areas.”

It noted the proposal also “set aside changes in operating practices the company was pursuing.”

With the deal, BHP has averted a strike at the world’s largest copper mine at a time of tight global supplies and high prices for the the orange metal, a key material needed for the world’s transition to a green economy.

The Escondida copper mine is responsible for about 5% of the world’s total copper output and Chile is the world’s top producer of the metal.

In 2017, unionized workers at the mine staged a 44-day strike, the longest in Chilean mining history. The labour action cost the company $740 million in losses and meant a contraction of about 1.3% of Chile’s GDP.

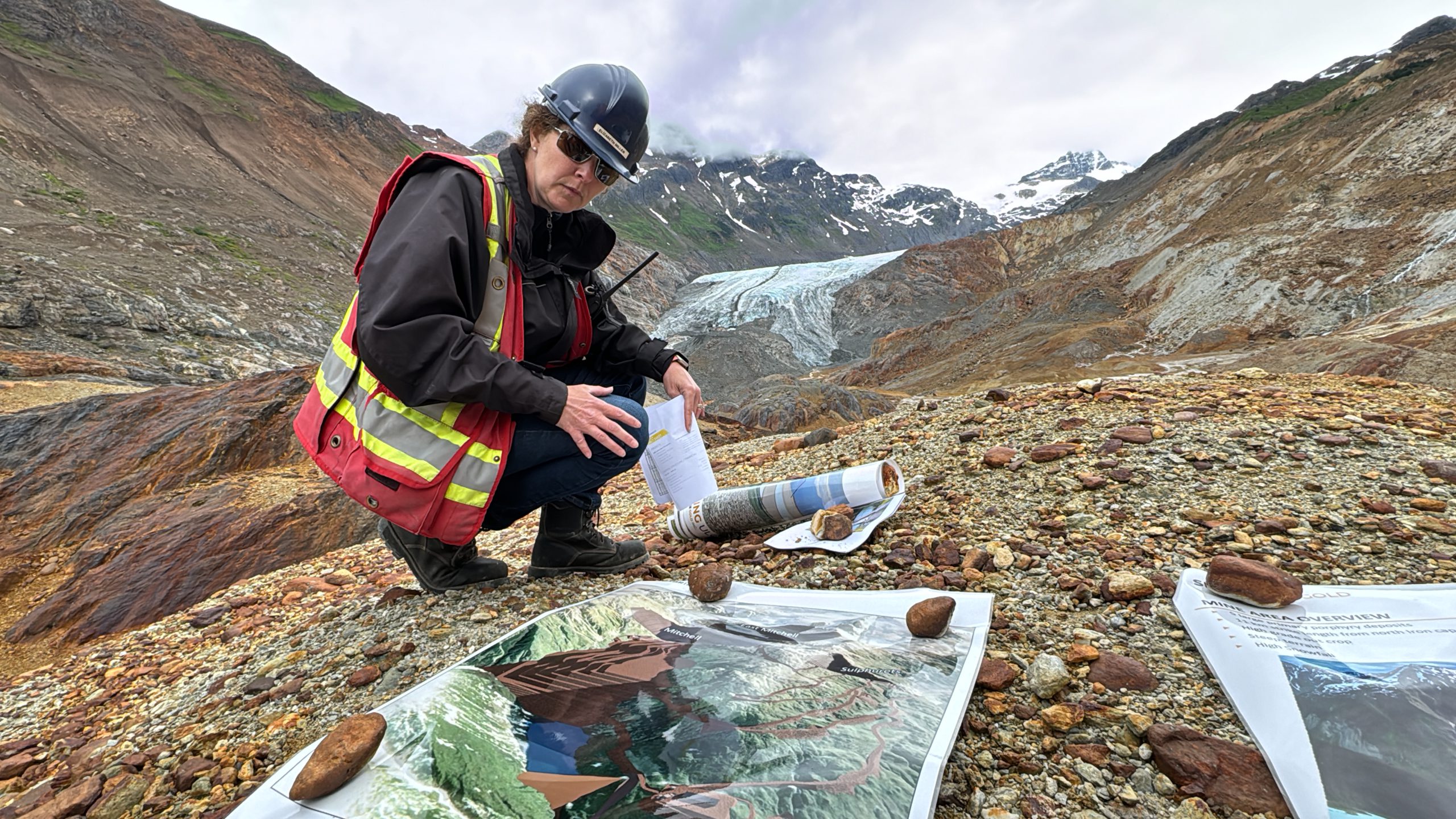

While Escondida is majority-owned and operated by BHP, Rio Tinto and a Japanese consortium that includes Mitsubishi Corp and JX Nippon Mining & Metals also hold stakes in the mine.

Chile’s state owned mining company Codelco, the world’s biggest copper producer, warned last week that global shortages of the metal may reach eight million tonnes by 2032, as soaring demand continues to offset new projects numbers.

THIS ARTICLE WAS ORIGINALLY POSTED ON MINING.COM