After the raise, the producer will hold 13.9 million shares of the explorer and 940,948 warrants. Assuming these warrants are exercised, Hecla would then hold 14.8 million shares of Dolly Varden, for a 11.3% shareholding.

According to the release, the shares are acquired for investment purposes and “Hecla does not have any present intention to acquire ownership of, or control over, additional securities of Dolly Varden.” Hecla plans on evaluating this shareholding on an ongoing basis.

Hecla is a silver producer, with mines in Alaska, Idaho and Mexico and also generates gold from mines in Quebec and Nevada. This year, the company expects to generate 10.9 to 11.9 million oz. of silver and 195,000 to 208,000 oz. of gold.

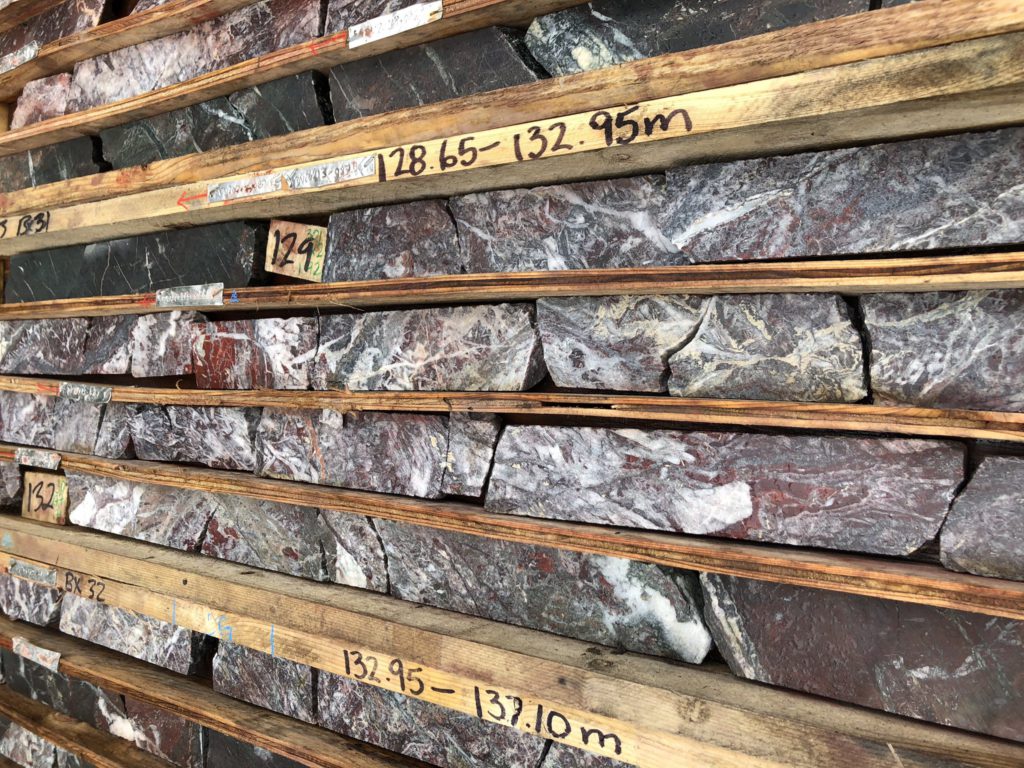

Dolly Varden is a B.C.-focused silver explorer, where it holds 88 sq. km of ground within the past-producing Dolly Varden project in the northwestern part of the province, in the Golden Triangle. The property includes an indicated resource of 3.4 million tonnes, grading 300 g/t silver; and an inferred resource of 1.3 million tonnes, at 277 g/t silver.

For more information, visit www.Hecla-Mining.com or www.DollyVardenSilver.com.