R&D investment at Yiliping totalled approximately $7 million and a 1kt scale pilot line started operation in April. After running consecutively for two months, test results showed improvements in lithium recovery rates and processing cost compared to historical processing methods.

Initially, Minmetals Salt Lake adopted a membrane technology provided by Jiuwu Hi-Tech, though a solar evaporation stage was still essential and it took 18-24 months to produce concentrated brine from which lithium could be extracted.

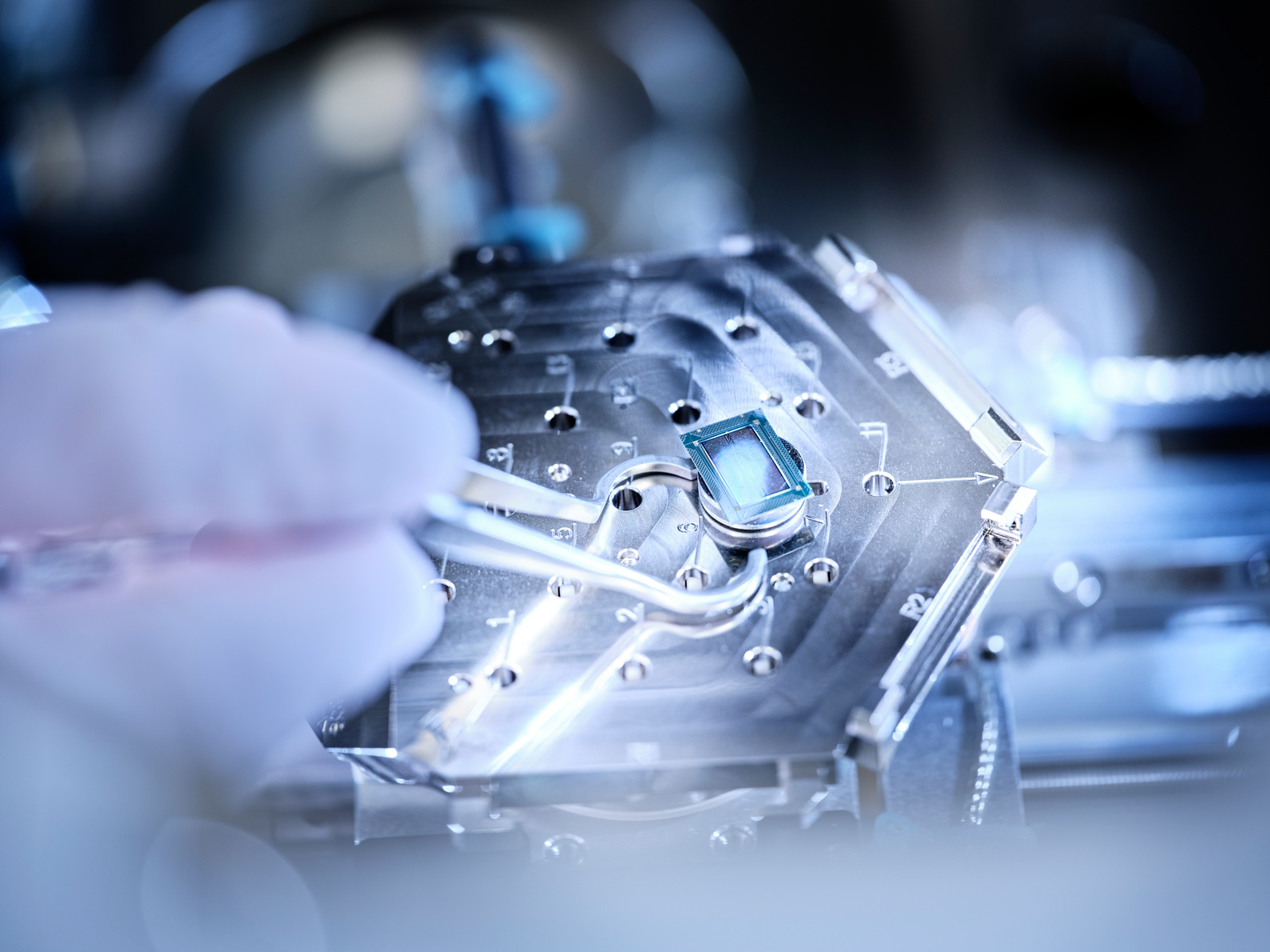

The new direct lithium extraction technology, on the other hand, shortens the extraction process to 20 days, can be applied in the initial concentration stage of processing and uses membrane separation later to extract lithium from solution, increasing the current capacity without significant investment.

According to Roskill, given that China relies heavily on imported raw materials to produce lithium products, crucial in Li-ion batteries, the development of domestic lithium resources such as Yiliping is seen as the key to establish supply security and help Chinese companies remain competitive. This is why the government released its “Action Plan for Building a World-Class Salt Lake Industrial Base,” which shows Xi Jinping’s determination to support the development of brine assets in China.

“China has abundant brine resources located in Qinghai province, but the quality of resources with low lithium content, though high Li:Mg ratio, has impeded production,” Roskill’s analysis reads. “If direct lithium extraction technology can be successfully applied to Minmetals existing operation and other Salt Lake assets in China, lithium extracted from brine would be expected to contribute a greater portion of global supply.”

Minmetals Salt Lake is a subsidiary of Minmetals Group, which earlier this year signed a $225-million deal with Ganfeng Lithium for the latter to take a 49% stake in the Salt Lake project.