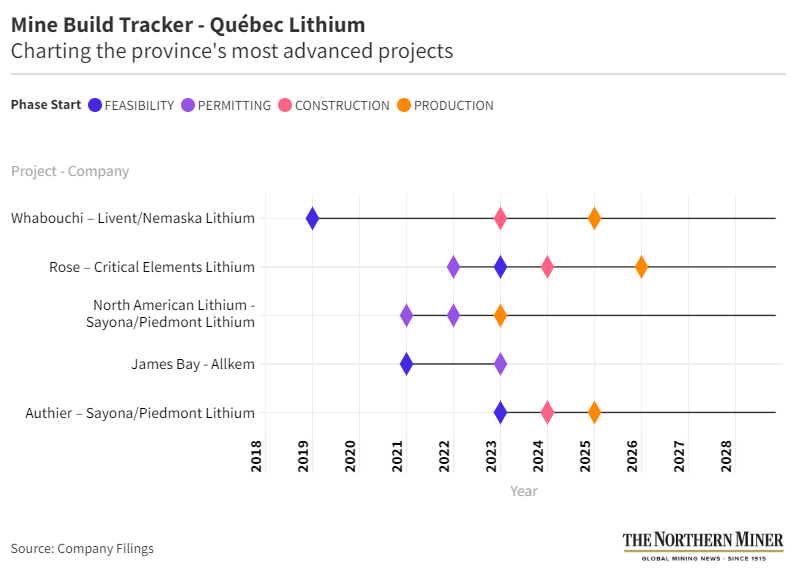

NAL, owned in a 75-25 partnership with Sayona and Piedmont, produced its first lithium concentrate in March and shipped a commercial load of spodumene in August. Located in the western Abitibi-Témiscamingue region, NAL’s output in March marked the restart of the mine after the partners purchased it in August 2021 from North American Lithium Inc. They updated the mine’s permits between 2021 and 2022. Annual output is forecast at 226,000 tonnes of concentrate over a 20-year life, according to a feasibility study released in April for NAL and Authier. NAL hosts proven and probable reserves of 21.7 million tonnes Li2O at 1.08% Li2O for 235,500 tonnes.

The Authier project is located just 70 km from NAL. The partners’ feasibility study forecasts construction starting in the spring of 2024 and production in the third quarter of 2025. With a relatively low pre-production capex of about $75 million, Authier would function as a satellite deposit of NAL. It has a mine life of 22 years. It hosts proven and probable reserves of 11.2 million tonnes grading 0.96% Li2O for 108,300 tonnes.

Whabouchi, located in the Eeyou Istchee James Bay region has an estimated production start date of 2025. Construction began in 2018 and is ongoing. It has a capex of $447.1 million. In May, Nemaska and Ford reached a long-term agreement for the annual supply of up to 13,000 tonnes of lithium hydroxide, to be supplied from Whabouchi and produced at Nemaska’s plant in Bécancour, Que. Whabouchi hosts 36.6 million tonnes of proven and probable reserves grading 1.3% lithium oxide (Li2O) for 241,440 tonnes Li2O, according to an updated feasibility study released in 2019.

Critical Elements Lithium (TSXV: CRE; US-OTC: CRECF), whose Rose project is also located in the Eeyou Istchee region, forecasts construction starting in 2024 and production in 2026. Last year, the Quebec and Cree governments’ Environmental and Social Impact Review Committee recommended Rose be authorized. Its capex comes to US$471 million. According to an updated feasibility study in August, Rose holds probable reserves of 26.3 million tonnes grading 0.87% Li2O for 193,800 tonnes Li2O, and 2,300 tonnes tantalum for 138 parts per million tantalum.

While Allkem (TSX: AKE; ASX: AKE) received in January federal government approval for its James Bay project’s environmental and social impact assessment, it hasn’t yet committed to a production timeline. The company said in February it was preparing its construction permits for submission. Its updated feasibility study, published in August outlines production of about 321,000 tonnes over a 19-year life, with an estimated capex of US$286 million. It hosts resources of 54.3 million measured and indicated tonnes grading 1.3% Li2O for 706,000 tonnes, and 55.9 million inferred tonnes at 1.29% Li2O for 724,000 tonnes.