It’s not a bad analogy, really. Sputnik was a moment in history when Russia stunned America’s ego by putting the first satellite in space.

But win or lose, America has shown that it won’t go down without a fight. Back then, it sparked a period of massive investment into U.S. space exploration.

But who really won the Cold War ‘Space Race?’ Arguably, it wasn’t Russia or the U.S. It was stocks like Boeing, General Dynamics, and Lockheed Martin. Companies that benefited from massive U.S. government investment.

These contractors supplied NASA with rockets, satellites and propulsion systems, reaping a fortune from the U.S. government’s attempt to prove its ideological dominance over Russia.

So, how does that lead us toward the potential opportunities in this coming China versus US ‘AI-Race?’

The commodity angle

The challenge for the tech sector is to optimize the 118 elements found on Earth, and turn these into innovative creations that better humanity.

But among all those elements, silver holds the most important physical characteristic in the modern age because it’s the world’s most conductive material. That makes it a key ingredient in high-end AI chips.

However, large-scale data centres also require silver for electrical components and cooling systems. Given its supreme physical characteristics, the application for silver across the AI landscape is limitless.

However, another commodity worth considering is the poorly understood high-purity alumina (HPA) market. This highly refined bauxite ore removes impurities, giving it unique physical characteristics.

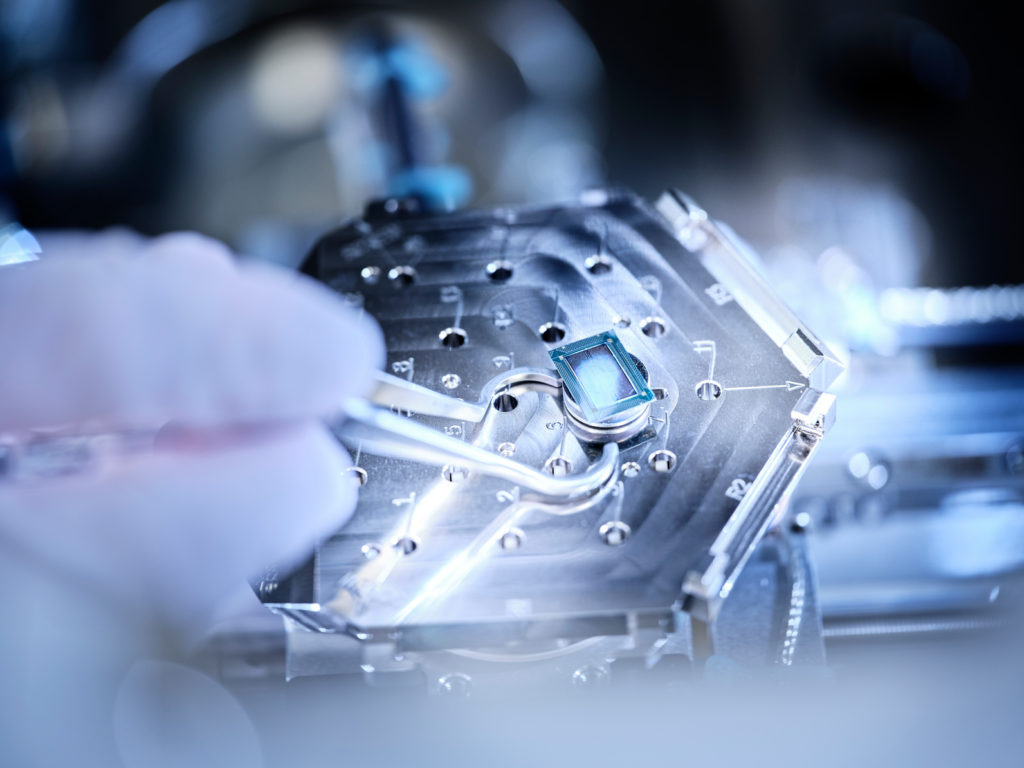

Unlike silver, HPA is not used directly in AI chips, but it plays a critical role in producing semiconductors, sapphire substrates, and chip fabrication equipment. These are sectors that link with the broader ‘AI architecture.’

But HPA producers are not your traditional resource plays. In this niche market, the true value lies in their respective proprietary methods for processing HPA, rather than the value of their raw ore.

Typically, HPA producers use kaolin clay or bauxite ore, a cheap and readily available material in Australia. Finally, Aussie start-ups value-add their product rather than sending it for processing overseas. Iron ore miners take note!

Some of the more advanced HPA plays in Australia include: Altech Batteries, Cadoux Limited and my favourite, Alpha HPA.

Each has its own specialized proprietary method.

Without going too deeply into the weeds, it initially involves refining the raw ore to remove impurities. Then, it’s leached using hydrochloric acid, which selectively extracts alumina. It’s then purified to remove further impurities.

The final step is known as calcination, where the purified alumina is heated to produce HPA for high-value markets.

Raw material advantage

There is a benefit to producers supplying raw materials to tech companies rather than owning these tech stocks directly.

The dramatic market action earlier this month showed that the AI race will be a high-stakes game for the tech giants, where today’s leaders could rapidly become tomorrow’s laggards.

Innovation is taking place rapidly, which throws up a lot of uncertainty for tech-focussed investors.

Now compare that to the raw materials used to supply this sector.

Miners will extract and process ore, as they’ve always done. Supplying an industry that must then compete for the best way to utilize those materials.

Yes, technology itself could alter the demand for certain minerals. For example, alternatives to traditional lithium-ion batteries could impact future lithium demand.

But in my mind, this presents far less risk. Especially for a commodity like silver.

The laws of physics dictate this metal will remain the most conductive element on Earth, regardless of how much innovation takes place!

When it comes to HPA, it’s sourced from cheap, abundant raw materials, so finding an alternative mineral that might displace demand for HPA in the years ahead is likely low.

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.